by Jamie Linden, Alan DiFiore, & Jim Kouf

TriStar Pictures

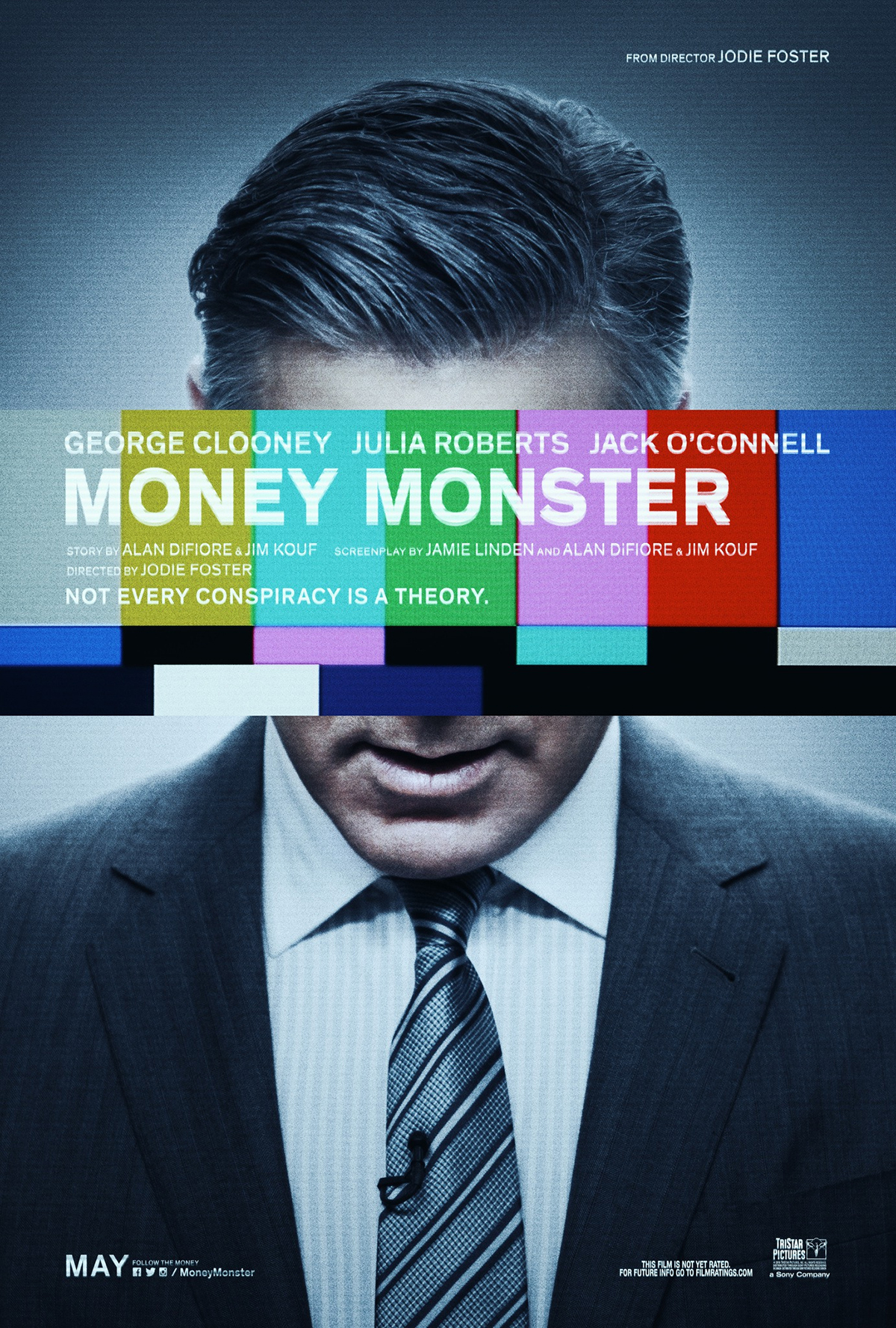

I guess we are finally in a place to process the financial collapse through art. In the past six months, we’ve had three movies looking at different aspects of it – 99 Homes, The Big Short, and this one, Money Monster. Two of those have been waaaaaaay more successful at it than the other.

I mean, this isn’t as on the nose as the other two, but this is a movie about how one company manipulated the stock market to turn a fuck ton of money into a metric fuck tonne of money, and the rage that erupts when things go horribly wrong.

Also it has George Clooney and Julia Roberts charismatizing at each other, which is always fun.

The Cloon plays Lee Gates, a Jim Cramer type who has a weekly cable show about what stocks to spend money on. He is obnoxious, and aggravating, and is more about spectacle than substance. La Roberts is his show’s director, Patty Flynn. It’s her job to manage what cameras are rolling and make sure the correct graphics are up on the screens. It’s a mark of how long they’ve worked together and what a well-oiled machine they are that she can create the show around his chaos.

The plot shows up the day after the price of a company crashes HARD, due to a “computer glitch.” A young man, Kyle, crashes the show with a gun and bomb vest, demanding answers as to why this stock, this stock that Gates had said was a sure thing, crashed. He lost all his money, and he has obligations, and all he wants are answers. He’s done the math; he knows how this will end. Concurrently, the Chief Communications Officer of the company that lost a lot of money, played by Caitriona Balfe (from Outlander), is also trying to figure out what happened to all of this money that vanished. Good luck with that, because the stock market is a fucking mystery.

The action, which is all being broadcast on live TV, is shown though three main points of view: Lee, who is living this; Patty, who is directing the show; and people who are watching all of this live. It take place almost in real time- the movie is about 90 minutes long and the action is about that. It’s a tight, tight story. There isn’t much fluff, and Jodie Foster, who directed this, knows what she’s about.

Here’s the problem as I see it: the financial crisis and the way the stock market has failed isn’t a result of a single boogey man who did an act of shadiness and fucked everyone around him. It was a major, systemic collapse that resulted because of the actions of a lot of people and institutions. Narrowing it down to, “Well it was this one dude and people followed him because he said he’d make them all money” means the justified anger isn’t focused on the problem and there won’t be a fix. We threw this dude in jail, big deal. Nothing is going to change.

The movie is a revenge fantasy, and doesn’t really hold up as a scathing critique of the financial system. It’s too simple. This does sort of slam shows like Jim Cramer’s and how all the hype about stock market shit (seriously you guys, I DON’T GET IT, my dad has tried to explain it to me several times) feeds into magic money that doesn’t really exist. It also has a few pointed things to say about the voyeuristic media as the 24 hour news cycle jumps on this story and people gather to watch it unfold. (And then quietly go back to their lives after it ends.) There’s a lot of rage, and it’s justified, but I just don’t think it’s focused.

There’s a point when Kyle tells Gates that he lost $60,000, and Gates is like “That’s it? I lost way more than that! I can give you $60K right now!” and Kyle tries to explain that to him, $60,000 was EVERYTHING he had. It may seem like pocket change when it’s less than 1% of your net worth, but when it’s everything you have, it’s not insignificant. There are certain factors within the markets and the political machine that allows people who possibly have never understood that to continue unaffected.

As a study of how a well-oiled machine works, it’s revealing. It usually works because a woman is doing a lot of the work to make it a machine, as Patty is. Yeah, Lee trusts her to be able to follow his lead, but it’s without actual collaboration. She’s the one that needs to put the work into to understanding the patterns of his chaos and it’s her job to take his chaos and make it look seamless and professional.

I enjoyed it while I was watching it, but now that I’m thinking back, a lot of it just doesn’t hold up.

Money Monster is in theaters now and you can find tickets (US) at Fandango and MovieFone.

Hoping to take my mom to see it this week. I think it sounds like the kind of movie that can wait for the DVD, but Love & Friendship isn’t playing here, so this is what she picked. I like the idea it plays out in almost real time. And Clooney and Roberts are usually fun.

I liked this a little more than you did, primarly because we have strong women working to manage/figure out the chaos and damage others have created. Julia Roberts’s Patty is the person you want in charge of all the things; she is going to corral the wild mustangs and keep the whole show going dammit because failure is not an option.

As I typed that last bit, part of me sighed at the memory of a conversation my sister and I had. Why do men run the world? Because it’s the only job we aren’t already doing. NB: a reflection of a personal reality, not male-bashing in general.

I don’t think this movie was meant to explain the entire financial collapse, just an aspect of what’s out there still and the part we play as viewers/followers. There’s the issue, too, of personal responsibility: do you gamble more than you can afford to lose?

The production of the TV show put me in mind of THE NEWSROOM, how controlled chaos behind the scenes seems to be the norm. Not the job for me, but I can appreciate the choreography.

I was on the bus this morning and saw a couple of billboards of this movie and wondered “is it any good”?. Then here’s your thoughtful review….thanks!

I expect I’ll see this at home at some point, because I am a fan of the three major names. Not expecting much in the way of “this is how financial markets work” from any fictional movie, much less one framed as a thriller. (Apparently there is nothing thrilling about financial markets unless you are on the trading floor with a snootful of cocaine.) For me, sufficient reason for seeing this will be George & Julia.

This actually sounds like it could have been a pilot for a 6- or 8-episode series. There is a lot that could be done with “blaming the messenger” vs. the true complicity of corporate media in keeping citizens dumb.

I’ll sit this one out. I suspect I’d be too annoyed with the idiot who blew all his money on a get-rich-quick stock tip. Although there are exceptions, playing the stock market is a chump’s game for the average person. You need to have a certain level of funding *that you can afford to lose* going in. And it takes a lot of time, energy, and expertise to work the system on your own. I guess I’m just cynical enough to think the whole thing is rigged to some extent or another to have much sympathy for any of these characters.

Maybe the hot weather is making me cranky. For those who do go to see this, enjoy the movie!

I haven’t seen this movie, but I work in the financial services industry, so I can still comment. 🙂 Diversification is what saves you from losing everything. One financial advisor I worked with told me that you should *never* have more than 10% of one security/company in your portfolio. At the time my 401(k) was probably 50% company stock. I did what she suggested, and I was so glad I did, because the stock cratered in 2008! I heard her on the phone with a client once talking about some “hot tip” the client had received, and she said, “You want to gamble. Let’s not call it investing; it’s gambling.”

On the other hand, I still wish I had bought lots of Citigroup for $1! It’s now trading at $46. Actually, I’m not serious; at the time no one knew if Citigroup would end up the same as Lehman Brothers, completely bankrupt. It was a very scary time for our industry!

At the beginning of the review the movie “99 Homes” is mentioned. I thought it was very good and didn’t get the love and attention or

deserved. Michael Sheehan is a compelling actor, whether playing a good guy or, as here, the villain of the piece. He’s believable and even oddly sympathetic as he explains how he came to do what he does, but you never forget that he’s the Bad Guy. I recommend it.

Spouse and I saw the movie this weekend. Very good acting. Very good script. Outstanding directing. I really appreciated how the plot avoided several of the usual tropes.

That said, the whole business of “math and algorithms don’t lie. There are human fingerprints all over this,” isn’t plausible. As spouse, who is talented both with limericks and investments, explained to me, those algorithms are not infallible. He cited the day when GE lost 20% in a few minutes because those algorithms got stuck in a cycle. Apparently these crashes happen from time to time.

(But I also enjoyed Independence Day, in spite of that truly stupid scene with Jeff Goldblum hacking into the alien computer system using his Mac.)